Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, ‘If you’ve been playing poker for half an hour and you still don’t know who the patsy is, you’re the patsy.’ When they buy such story stocks, investors are all too often the patsy.

So if you’re like me, you might be more interested in profitable, growing companies, like Serba Dinamik Holdings Berhad (KLSE:SERBADK). Now, I’m not saying that the stock is necessarily undervalued today; but I can’t shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Serba Dinamik Holdings Berhad

How Quickly Is Serba Dinamik Holdings Berhad Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you’d expect a company’s share price to follow its earnings per share (EPS). It’s no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud Serba Dinamik Holdings Berhad’s stratospheric annual EPS growth of 39%, compound, over the last three years? While that sort of growth rate isn’t sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

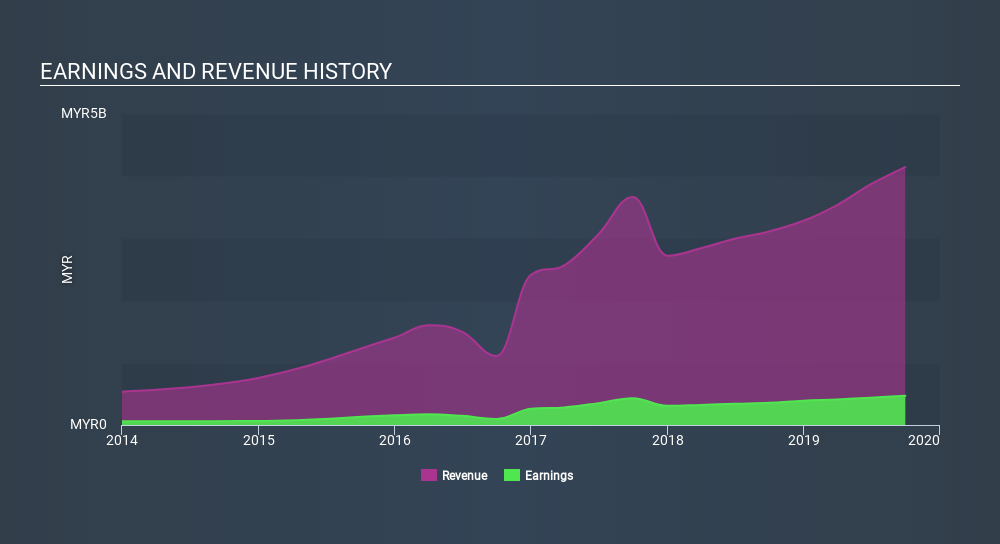

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Serba Dinamik Holdings Berhad’s EBIT margins were flat over the last year, revenue grew by a solid 33% to RM4.1b. That’s a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment at all times, there’s no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Serba Dinamik Holdings Berhad?

Are Serba Dinamik Holdings Berhad Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we’re pleased to report that Serba Dinamik Holdings Berhad insiders own a meaningful share of the business. In fact, they own 50% of the shares, making insiders a very influential shareholder group. I’m always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. And their holding is extremely valuable at the current share price, totalling RM3.7b. That means they have plenty of their own capital riding on the performance of the business!

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like Serba Dinamik Holdings Berhad with market caps between RM4.2b and RM13b is about RM2.3m.

The Serba Dinamik Holdings Berhad CEO received RM1.4m in compensation for the year ending December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn’t a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Serba Dinamik Holdings Berhad Worth Keeping An Eye On?

Serba Dinamik Holdings Berhad’s earnings have taken off like any random crypto-currency did, back in 2017. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The sharp increase in earnings could signal good business momentum. Serba Dinamik Holdings Berhad certainly ticks a few of my boxes, so I think it’s probably well worth further consideration. While we’ve looked at the quality of the earnings, we haven’t yet done any work to value the stock. So if you like to buy cheap, you may want to check if Serba Dinamik Holdings Berhad is trading on a high P/E or a low P/E, relative to its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.